does utah have an estate or inheritance tax

However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million in 2022 2412 million for couples. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022.

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Utah does not have a state inheritance or estate tax.

. Overview of State Taxes in a Chart. The chart below shows which states currently collect state individual income taxes state sales taxes state estate taxes state inheritance taxes andor state gift taxes. Although Utah does not currently impose an estate or inheritance tax--i recommend.

In 2021 this amount was 15000 and in 2022 this amount is 16000. Utah does have an inheritance tax but it is what is known as a pick-up tax. Utah does not have a state inheritance or estate tax.

Utah does not require an Inheritance Tax Waiver. However if the property exceeds the federal estate tax exemption bar of 1206 million it becomes subject to the federal estate tax. However there is still a federal estate tax that applies to estates above a certain value.

Utah residents do not need to worry about a state estate or inheritance tax. No estate tax or inheritance tax. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

Its actually is not that uncommon. The top estate tax rate is 16 percent exemption threshold. Utah does not have a state inheritance or estate tax.

Estate tax of 10 percent to 20 percent on estates above 22 million. Utah has neither an inheritance tax nor an estate tax. However there is still a federal estate tax that applies to estates above a certain value.

Fortunately Utah does not assess an estate tax. Utah does have an inheritance tax but it is what is known as a pick-up tax. Most states dont levy an inheritance tax including Utah.

Inheritance taxes are paid at the beneficiary level after any estate taxes have been paid after settling estate taxes. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax. No estate tax or inheritance tax Vermont.

This means that the amount of the Utah tax is exactly equal to the state death tax credit that is available on the federal estate tax return. Utah does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Utah does not have a state inheritance or estate tax.

Note that local governments at the county or city level may collect one even if the state does not. How to reduce the taxable part of an estate in Utah. However a beneficiary who lives in another state may have to pay inheritance tax if the beneficiarys state of residence charges an inheritance tax even though the estate is administered in Utah.

Even though Utah does not collect an inheritance tax however you could end up paying. If the gift or estate includes property the value of the property is determined by the fair market value of that property. Just when you thought the estate tax had lost its bite it turns out more states want to tax your estate.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Utah State Income Tax Calculator Community Tax

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

Judicial Vs Non Judicial Foreclosure Utah Divorce Lawyers West Jordan Utah

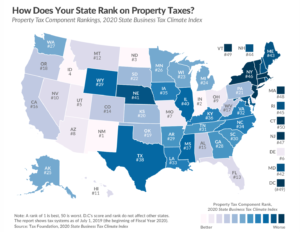

Utah S Property Taxes Continue To Be Recognized As One Of The Best In The Nation Utah Taxpayers

Utah Estate Tax Utah Inheritence Tax Credit Shelter Trust Gift Tax

A Guide To Inheritance Tax In Utah

Utah Inheritance Laws What You Should Know

Adoption Taxpayer Identification Number Family Law Attorney Divorce Lawyers Divorce Attorney

Utah Estate Inheritance Tax How To Legally Avoid

Shadley Soter Utah Needs To Raise The Estate Tax The Daily Utah Chronicle

Historical Utah Tax Policy Information Ballotpedia

How Do Probate Records Show Probate Family Law Attorney Divorce Lawyers

Voices For Utah Children State Estate Taxes A Key Tool For Broad Prosperity Estate Tax Inheritance Tax Prosperity

A Guide To Inheritance Tax In Utah

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance